idaho state capital gains tax rate 2021

The federal government taxes long-term capital gains at the. If your taxable income is 47000 and youre filing as a single person youd pay tax at a rate of 15 on those gains making your long-term capital gains tax bill 1200.

Idaho Income Tax Calculator Smartasset

Plus 3125 of the amount over.

. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. 380 which effective retroactive to January 1 2021 lowers the top personal income tax rate from 6925 to 65 reduces the. Plus 1125 of the amount over.

All Major Categories Covered. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. 2021-2022 Capital Gains Tax RatesLong-term capital gains taxes apply when you sell an asset at a profit after holding it for more than one year.

Taxes capital gains as income and the rate reaches 660. In May 2021 Idaho Governor Brad Little signed into law HB. Plus 3625 of the amount over.

063 average property tax rate. Short-term gains are taxed as ordinary income. Detailed Idaho state income tax rates and brackets are available on this page.

Include federal Form 6252. The tax rate on these gains ranges from 0 to. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Select Popular Legal Forms Packages of Any Category. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. 32 cents per gallon of regular gasoline and diesel.

Connecticuts capital gains tax is 699. Idaho has enacted several tax cuts in the past. Your capital gains deduction using the current years taxable portion of the installment payment.

Capital Gains Tax Rate 2021. The Idaho income tax has seven tax brackets with a maximum marginal income tax of 692 as of 2022. Short-term gains are taxed as ordinary income.

Tax Rate. Combined Rate 3193 Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent. Ad Instant Download and Complete your Tax Free Exchange Forms Start Now.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Taxes capital gains as income and the rate reaches. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Capital gain from an installment sale isnt. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Object Moved This document may be found here. However it was struck down in March 2022. If your income was between 0 and 40000.

The Ultimate Guide To Idaho Real Estate Taxes

Idaho Remains Fastest Growing State Utah Second Freeaccess Rexburgstandardjournal Com

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax Rates By State Nas Investment Solutions

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho State Tax Software Preparation And E File On Freetaxusa

State Taxes On Capital Gains Center On Budget And Policy Priorities

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Income Tax Calculator Smartasset

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

How To Set Up An Llc In Idaho 2022 Guide Forbes Advisor

Cities Balk At Washington State Capital Gains Tax City Journal

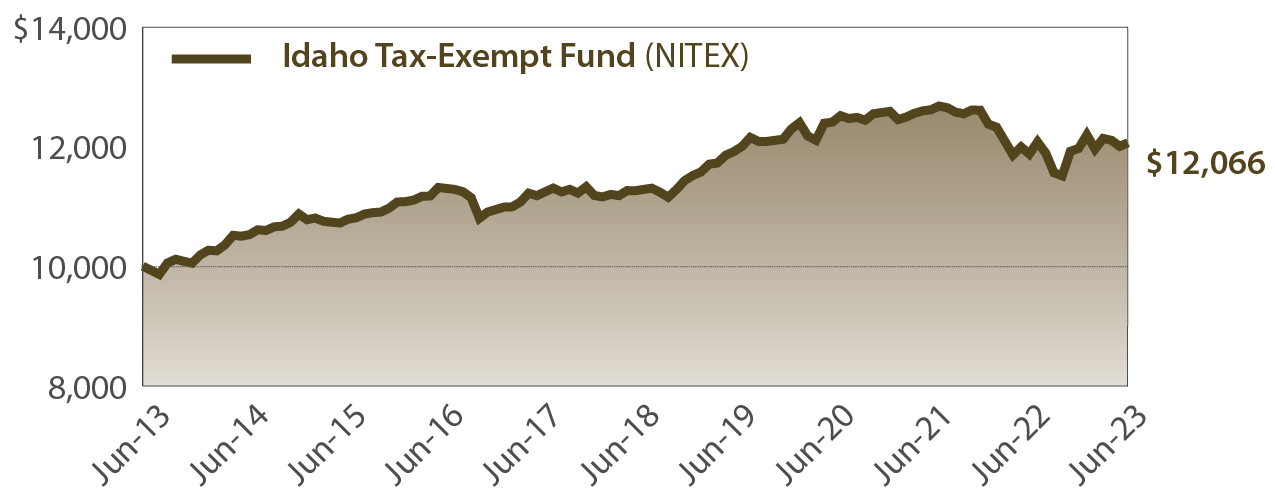

Idaho Tax Exempt Fund Saturna Capital

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses